It may seem like a silly question to some people, on par with asking the definition of a bank. But a checking account can mean different things to different people, and specifics can also vary significantly from bank to bank.

Keep reading to find out the details of how it all works so you can maximize the use of your checking account.

What’s the difference between checking and savings accounts?

At its core, a checking account is a type of deposit account with a bank or credit union that allows you to easily move money from one place to another. You can deposit money from one or more sources and then disburse that money to pay bills or make purchases efficiently.

Checking accounts differ from savings accounts in that the money is designed to be fluid. A savings account is just that — a way to save money. While you can deposit and withdraw money in similar ways to a checking account, a savings account is designed to grow money over time.

Savings accounts typically have beneficial features like interest rates, but also have fees associated with actions like frequent withdrawals or low minimum balances. Checking accounts also have fees attached, but they are different and typically result from overdrafting or having insufficient funds.

Check Out Our Top Picks for 2024:

Best Checking Accounts

How does a checking account work?

You can control your funds through various methods with a checking account. The most traditional way is with a check. Though not as common as they once were, you might still use a check to pay your rent or send in a particular bill every so often.

A check is a uniform document that instructs a bank to transfer funds from your account to the person or entity whose name appears on it. It can then only be deposited or cashed by the person or entity whose name appears on that check.

Years ago, using a physical check was the only way to move money out of a checking account. Depositing a payroll check from your employer meant receiving a physical check from them on payday. Then, you’d go to your bank, stand in line, and deposit your check directly with a teller.

Writing Checks

Your bank or credit union would issue you a checkbook with several checks for you to write out to anyone you owed money. The bank’s routing number, your checking account number, and the check number were encoded on the bottom left portion of the check.

You fill out the name of the receiver, the amount of the check and apply your signature. Then, deliver the check either physically or through the mail. This is still done today. However, banks and credit unions now offer many other ways to transfer money from your checking account to the receiver. The newer ways are much simpler, faster, and safer.

When opening a checking account, it’s important to think about how you’re going to use it and determine if the method of transfer and associated fees make sense for you.

How can you make deposits into your checking account?

These days, picking up a check from an employer and depositing it is a slow and unnecessary way to transfer your money. Banks now offer direct deposit, which electronically deposits your paycheck into your checking account. Instead of receiving a check from your employer, you receive a receipt of deposit.

Many banks and credit unions require direct deposit if you want to avoid monthly fees, so make sure you check with your employer to see if they offer it.

If your employer does offer it, it’s wise to sign up for it as quickly as possible. It ensures that your payroll check is deposited quickly and efficiently, and helps you avoid unnecessary fees that your bank may charge.

Debit Cards

Debit cards, also known as ATM cards, have truly revolutionized the banking business. They solved many issues in traditional banking, such as depositing or withdrawing cash while the bank was closed. Using a debit card also helps to reduce wait times and the number of tellers needed to complete physical transactions.

With your debit card, you can withdraw money at any time in just about any place. On the downside, you must pay ATM fees for withdrawing money from out-of-network ATMs. However, if the ATM you are using is from the bank in which you have a bank account, there are usually no fees associated with withdrawing money.

Out-of-Network ATM Fees

However, if you are using an ATM that is not associated with your bank, you can expect to pay $2 to $3 or more just to withdraw some cash. These fees can quickly add up if you use your card often at out-of-network ATMs.

Make sure you consider bank and ATM locations when choosing the checking account that is right for you. Additionally, note that you cannot deposit money into an ATM that is not from your bank.

If you travel a lot or are regularly in a different region or state, say for college or work, you should look for a bank that services multiple areas. This is especially true if you tend to withdraw cash from your bank accounts often.

Can you use a debit card as a credit card?

Most of them now double as credit cards in partnership with companies such as Mastercard and Visa. You can use these cards to purchase goods and services just like any standard credit card. The amount of the sale is automatically deducted from your checking account balance.

Physical cash is used less in transactions these days, and banks are making it easier and easier for you to spend money. Using your debit card as a credit card can eliminate the need to constantly seek and use an ATM.

Since there are usually no fees for using a debit card, it’s often more preferable than hunting down an ATM to access cash from your bank account. Keep in mind that many banks have daily and monthly withdrawal limits. It’s important to know what these limits are because your debit card may be declined if you go over the limit.

How can you use your checking account online?

Banks are making it easier to deposit, transfer, and access your money from your checking and savings account. Online banking through a bank’s website or phone app can give you instant access to your bank accounts as well as your bank statements.

Once your bank accounts are set up, you can easily see where your money is coming from and where it is going. Many banks allow you to transfer money directly from one bank account to another with just the recipient’s email address. Additionally, you can set up automatic payments for recurring bills such as electric, phone, or Internet.

Many bank apps now also allow you to deposit checks by simply taking a picture of the front and back of the check. You no longer need to physically deposit a check to move the money into your account. The need for a bank branch near your location is becoming less and less necessary as these technologies become more widespread.

What are the different types of checking accounts?

There are several types of checking accounts available, each with its own features and benefits. Below are some of the most common types of checking accounts:

- Basic checking accounts: A basic checking account offers the bare minimum, typically requiring a minimum deposit to open, with no additional fees associated. These accounts offer basic features, such as check-writing and debit card access, and are ideal for those who want a simple way to manage their money.

- Premium checking accounts: Premium checking accounts offer additional features such as higher interest rates, lower fees, and debit cards with rewards programs. These accounts typically require a higher minimum balance or a monthly maintenance fee, but offer greater benefits to account holders who meet these requirements.

- Student checking accounts: Student checking accounts are tailored for students, and often have fewer fees and restrictions. These accounts may waive monthly maintenance fees and offer other incentives to students, such as free checks or overdraft protection.

- Senior checking accounts: Senior checking accounts offer seniors exclusive benefits such as lower minimum deposits and waived fees. These accounts may also offer additional features such as free checks or ATM fee reimbursement.

- Interest-bearing checking accounts: An interest-bearing checking account allows you to earn interest on your account balance, which can be a great way to make your money work for you. High yield checking accounts typically require a higher minimum balance and may have additional requirements to qualify for interest.

- Business checking accounts: Business checking accounts are designed for commercial use and offer features tailored to the needs of businesses. These accounts may offer cash management services, such as remote deposit capture, and may have higher transaction limits.

- Rewards checking accounts: Rewards checking accounts provide cash back and other incentives for using the account. Accounts like Upgrade Rewards Checking Plus offer cash back on purchases, and other benefits to account holders who meet certain requirements.

- Second chance checking accounts: Second chance checking accounts are available to people with a history of banking problems, such as an overdraft or bounced check. These accounts may have higher fees and restrictions than other types of accounts, but can be a suitable option for those who have had difficulty opening a traditional checking account.

- Joint checking accounts: A joint checking account is simply a bank account held jointly by two or more people. Typically, couples or business partners who wish to share responsibility for managing their finances open a joint bank account. Joint accounts offer the convenience of shared expenses and can simplify bill-paying for couples or roommates.

Common Checking Account Fees

Checking account fees can add up quickly if you don’t live or work near your bank.

If you are someone who uses an ATM to withdraw cash often, you’ll want to open an account that has a widespread network of ATMs in areas that you frequent.

Monthly Maintenance Fees

When you hear the term “free checking,” it usually means an account with no monthly maintenance fee. A maintenance fee is charged by the bank monthly to maintain your account. On average, these fees add up to almost $160 annually, so finding a free checking account can save you a lot of money.

However, free checking accounts typically come with stipulations. Common requirements often include a minimum balance or a direct deposit requirement. If you can abide by the bank’s stipulations, you won’t have to pay the monthly service fee, and it can save you a lot of money in the long run.

Minimum Opening Balances

Minimum opening balances are also something to consider. Most banks have a minimum requirement for opening a particular type of checking account, but the amount can vary.

Basic accounts can swing from $25 to $100 or sometimes much more. If an account has a minimum balance requirement ranging from $100 to $500 or more, it’s easy to be hit with a monthly fee if your account balance dips below the required amount regularly.

Overdraft Fees

Another fee often seen with checking accounts is the overdraft fee. This occurs when you spend more money than you have in your account. If your account goes into negative numbers, the bank charges you an overdraft fee that can be $30 or more.

Obviously, the easiest way to avoid this fee is not to overdraw your account in the first place. This may seem elementary until you realize it can take different amounts of time for checks to clear, and you may have less money in your account than you realize.

You can opt out of overdraft protection so you don’t accumulate any fees, but doing so puts you at risk of having your card declined at the cash register. It’s up to you to decide which one is best for your situation.

See also: Checking Accounts With No Overdraft Fees

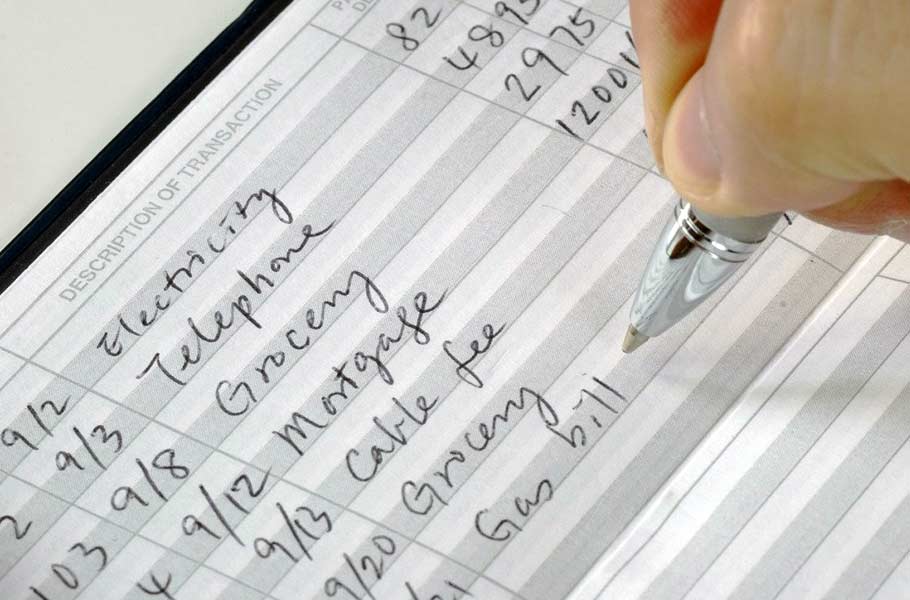

What’s the purpose of balancing your checkbook?

Unfortunately, financial mistakes are inevitable and some of them are caused by human error. These mistakes should be sufficient reason to balance your checkbook occasionally. But, it’s only the scratch on the surface; there are more reasons to balance your checkbook, as you’ll discover below.

1. Avert Banking Errors

Banking errors can be costly in the long run. The last thing you want is to be caught with unexpected fees or lack of funds because of poor record-keeping.

The good news is that you can avoid these errors by balancing your checkbook regularly. The most common banking errors to look out for include; data entry errors, omission, commission, transposition, duplication, and entry reversal.

2. Know Your Actual Balance

Preventing overdrafts begins with knowing your balance. However, you can only tell your true account balance when you regularly balance your checkbook. In addition, this also helps to avoid overdraft fees.

3. Identify and Report Fraudulent Activities

Fraudulent activities can cost you thousands in losses. Cybersecurity threats are more prevalent today, and you risk losing your hard-earned money to unauthorized people. According to Attila Security, the cost of cyber-attacks in the banking sector has surged to $18.3 million annually per company.

This number is extremely high and may be unsustainable for many companies and individuals. Therefore, one sure way to prevent loss of funds due to fraudulent activity is by monitoring your account regularly and reporting unauthorized transactions.

4. Helps to Save Money

Balancing your checkbook helps save the money you’ll be charged for bounced checks. This usually costs between $25 and $30 per bounced check. These fees add up quickly if you have multiple bounced checks.

5. Keep Up With Merchants

Merchants are also humans and are prone to making mistakes. While some errors can be intentional, others aren’t. It’s crucial to monitor merchant activity to ensure you’re not losing money in any way. This can only happen when you balance your checkbook frequently.

6. Budget Control and Cashflow Management

Keeping tabs on your account activity goes a long way to helping you budget effectively and manage your cash flow. Budgeting won’t be possible when you have no idea what’s happening in your checking account. Fortunately, balancing your checkbook keeps you abreast of your current balance and spending so that you’re never caught by surprise.

How to Open a Checking Account

Opening a checking account is a straightforward activity. Nonetheless, some people still find it pretty intimidating. To open a checking account in the U.S., you need to be at least 18 years old and a U.S. citizen or legal resident. Moreover, you can either open an account online or in person. If you’re wondering how to go about it, below is a step-by-step guide.

Step 1: Gather Personal Information

Gather all relevant information before starting the process. Ensure you have your government-issued ID. This can be a copy of your driver’s license, State ID, or passport. Some banks may also request secondary proof of identity like a Social Security number, proof of address, contact information, or a birth certificate.

Step 2: Prepare First Deposit (If Applicable)

Next, it will be best to have your first deposit ready to activate the account once it’s approved. However, please note this isn’t compulsory for many banks. That said, the minimum deposit will typically be around $25.

Step 3: Fill Out and Submit Application Form

Fill out the application form online or in person. You can always opt for what works best for you. Remember to sign the paperwork to activate the checking account.

Step 4: Fund the Account to Activate (If Applicable)

Lastly, fund the checking account by making your first deposit, if applicable. Keep in mind that some banks are flexible and won’t require you to deposit any amount to activate the new bank account. You can fund the account through wire or electronic transfer. A physical check or cash should also work.

How to Close a Checking Account

Closing a checking account is a straightforward exercise. However, you may make mistakes that’ll cost you, such as unexpected overdraft charges and related fees. That’s why it’s crucial to get the process right from the onset. Below are the steps to follow to close your checking account.

Step 1: Open a New Checking Account

First, it’s a good idea to open a new checking account before closing the current one. This is because you need a new account to transfer any money from your old checking account. So, follow the steps above to open a new account if you don’t know how to do it.

Step 2: Stop Using the Current Checking Account

Next, you want to stop using the current checking account and let any charges clear. Depending on your available active billings, you can do this for a month or whatever duration is needed. Most importantly, remember to cancel any automatic payments running on the current account.

Step 3: Transfer Balance to New Checking Account

Next, you should move money from the current checking account to the new one before closing the account permanently. But before doing this, ensure you’re aware of the permitted transfer limit or any pending charges to avoid overdrafts. Then, proceed to close the account by writing a letter to the bank or visiting them in person.

Step 4: Get Rid of Old Checkbooks and Debit Cards

Lastly, destroy old checkbooks and debit cards so that they don’t land in the wrong hands. Unfortunately, if this happens, they can be used for fraudulent activities.

Step 5: File Old Records for Future Reference

Proper filing can save you from stress a few years down the line. This is because you may encounter fraudulent activities in your old account. Therefore, you’ll want to ensure you’ve kept the account closure confirmation letter to prove you no longer operate the account.

How to Find Your Checking Account Number

Your checking account number is usually 10 to 12 digits long. There are several places you can find it:

- At the bottom of your checks

- On your monthly statement

- Your Bank’s Website or Mobile App

- By Contacting Your Bank

Learn more: How to Find Your Bank Account Number

How to Choose a Checking Account

Choosing the checking account that’s right for you typically comes down to cost versus convenience.

Before you decide, make a list of priorities. You’ll be in a better position to choose the right bank and the right checking account if you understand how your money moves in and out of it.

If you work in a restaurant and most of your income is from tips, you may look for a bank that has 24-hour ATMs nearby that easily allow you to deposit cash.

Most checking accounts are insured by the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Administration (NCUA). The FDIC and NCUA both provide a standard insurance amount of$250,000per account, per bank or credit union. This insurance protects bank depositors against losses if the bank or credit union fails.

If you’re an out-of-state college student, you may want to start your search with banks that service multiple states. Whatever your situation, there’s going to be a checking account for you. Do your research and match one that fits your lifestyle.

How much can I overdraft my checking account?

The overdraft limit varies from one bank to another. Nonetheless, the limit typically ranges between $100 and $1,000. You can overdraw your checking account by check, electronic transfer, or cash withdrawals at the ATM.

How old do you have to be to open a checking account?

Banks require everyone opening a checking account to present a valid government-issued photo ID. This means that you should be at least 18 years old to open a checking account. However, you can still co-own one as a minor if you decide to open a joint account with your parent or legal guardian.