Many people find themselves in a situation where they are unable to make timely payments on their auto loan. In some cases, the lender will take possession of the vehicle and sell it at auction.

This is called repossession, which means that you have lost your car because you’ve missed payments. Even if you pay what’s owed and remove the sale from public record, it may still affect your credit score for years to come. Here’s how to keep this serious setback off your credit report once and for all!

How long does a repossession stay on your credit report?

A car repossession stays on your credit report for up to seven years. This means that if you first missed a payment leading to the repossession in January 2020, the repossession would remain on your report until January 2027.

However, the negative impact of the repossession tends to decrease over time, especially if you take proactive measures to improve your credit health. It’s also essential to note that the repossession’s presence on your credit report doesn’t prevent you from rebuilding and restoring your credit profile.

While those seven years might seem long, with the right strategies and responsible financial behaviors, you can mitigate its effect and work towards a more favorable credit standing.

How does a repossession affect my credit score?

A repossession on your credit report can have a profound negative impact on your credit score, and it’s not just the repossession itself that does the damage. Here’s a breakdown of how a repossession can influence your score:

- Missed payments: Leading up to the repossession are typically several missed loan payments, each of which can chip away at your score.

- Accumulated fees: Various charges, from late payment fees with interest to towing and storage fees for the repossessed vehicle, can pile up and further harm your credit.

- Outstanding debt: After the repossession, if the vehicle’s sale doesn’t cover the remaining loan balance, this outstanding amount is another negative mark against your credit score.

- Deficiency balances: If your vehicle is sold or auctioned for less than what you owed, you’re still on the hook for the difference, which can further lower your score if left unpaid.

- Legal judgments: If a lender takes legal action to recover the deficit and succeeds, the resulting judgment can significantly tarnish your credit report.

Combined, these factors can cause a sharp decline in your credit score, sometimes by over 100 points. This drop can push you into the category of bad credit, leading to higher interest rates and fewer financial opportunities. Furthermore, the mark of a repossession can stay on your credit report for up to seven years, acting as a long-lasting testament to previous financial challenges.

Ready to Raise Your Credit Score?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.

Why do repos happen?

A car repossession typically occurs when you’ve fallen behind on your auto loan payments.

When you get an auto loan, the bank you have the loan through technically owns the car until the loan is paid off in full. If you stop making monthly payments, the bank can essentially take their car back from you.

Your lender can seize your vehicle at any time once your loan is in default. In most states, they don’t even need to notify you that they will do this. Lenders will typically then sell the vehicle to attempt to recoup the money they loaned for its purchase.

Does voluntary repossession make a difference?

At first glance, one might assume that choosing a voluntary repossession would be seen more favorably by credit bureaus than being forced into an involuntary one. However, when it comes to credit assessment, both a voluntary and involuntary repossession are largely viewed through the same lens. Choosing a voluntary repossession doesn’t cushion the blow to your credit score; its impact is just as significant.

Can I be sued for the remainder of the balance?

Beyond the immediate repercussions of having your vehicle taken, there’s an added financial aspect that borrowers often overlook. The lender, after repossessing and subsequently selling the vehicle, can take legal action against you if the sale doesn’t cover the remaining balance of your loan.

Consider this scenario: Imagine you still have an outstanding balance of $15,000 on your car loan when your vehicle gets repossessed. If the lender manages to sell the repossessed car for only $10,000, this leaves a deficit of $5,000. This outstanding amount, known as the “deficiency balance,” becomes your responsibility.

Lenders frequently resort to legal action to recover this deficiency. If they choose to sue and win the case, not only are you responsible for the deficiency balance, but a judgment will also be entered against you.

This judgment on your credit report presents another challenge to your financial health. Such judgments can severely impact your credit score, limit your ability to secure future loans, and can even lead to wage garnishment in some states.

Can a repo be removed from your credit report?

Yes, a repossession can potentially be removed from your credit report, but the process is not always straightforward. Here are some ways it might be removed:

- Dispute inaccuracies: If the repossession entry on your credit report contains errors or inaccuracies, you are entitled to dispute it with the credit bureaus. They are required to investigate and, if found inaccurate, must remove it.

- Negotiate with the lender: Some lenders might agree to remove the repossession from your credit report if you negotiate a settlement or pay off the owed amount. It’s essential to get any such agreement in writing.

- Seek professional help: Consider consulting with a credit repair agency or attorney who specializes in credit issues. They can provide guidance on your specific situation and might have strategies to help remove negative marks.

Remember, even if the repossession remains on your credit report, its impact diminishes over time, especially if you engage in effective credit-building activities.

How to Dispute a Repossession

The Fair Credit Reporting Act (FCRA) requires that negative items on your credit report be accurate and true. So, if you can find errors in the reporting of the repossession on your credit report, you can have it completely removed. And the burden of proof is on the credit bureau.

To remove a repossession, you will need to file a dispute with each credit bureau reporting it. The credit bureau must remove the repossession from your credit report if the lender can’t verify the repossession is valid or fails to answer the dispute within 30 to 45 days.

To file a credit bureau dispute, you will first need to get your credit reports. You can get a free credit report from each of the three major credit bureaus at AnnualCreditReport.com.

Once you have your credit reports, you will want to see if it’s reporting on all three credit reports, and then look for any errors or inaccuracies. You will then report the error to the credit bureaus reporting it by filing a dispute. You can do so by phone, mail, or online. Sending a dispute letter is the best way to do it.

Can I get a car loan after a repossession?

Yes, securing a car loan after a repossession is achievable, though it may pose some challenges. Lenders may view a repossession as a risk, but several factors can aid in your approval:

- Time since repossession: As this negative mark ages, and you engage in positive credit activities, its impact lessens.

- Current credit score: A respectable score, despite the repossession, can make lenders more receptive to your application.

- Down payment: Offering a significant down payment can show lenders your financial commitment and may offset perceived risks.

- Stable income: Providing proof of consistent income can assure lenders of your ability to manage a new loan.

- Specialized lenders: Some lenders cater to those with imperfect credit histories, though they might offer loans at higher interest rates.

What can I do to rebuild my credit after a repossession?

There are several things you can do to start rebuilding your credit after a repossession. Some of these things you can start doing immediately.

- Pay all of your bills on time – Payment history accounts for 35% of your FICO credit score, so paying your bills on time is crucial. When a late or missed payment occurs, it’s reported to the credit bureaus and can remain on your credit report for up to seven years. Even if you only make the minimum monthly payment, it’s essential to pay your bills on time.

- Try to pay down your debt – A lower credit utilization ratio (amount of available credit you’re using) can help boost your credit scores. There are a few different strategies for paying down debt. Consider the debt snowball or debt avalanche method.

- Check your credit report for errors – Ensure that all the information listed is accurate and up-to-date. Carefully review your credit reports for any incorrect or outdated information. This includes incorrect account numbers, incorrect addresses, incorrect payment history, or accounts that don’t belong to you. If you find any errors, you’ll need to dispute them.

- Consider a secured credit card – A secured credit card is a type of credit card that requires you to put down a security deposit to use the card. The amount of the security deposit is usually equal to the amount of the credit limit. When you use the secured card and make timely payments, they’ll be reported to the three major credit bureaus, allowing you to build your credit history.

- Consider a credit builder loan – Credit builder loan are designed to help you improve your credit score. By offering a small loan amount for regular repayments, they operate similarly to secured cards, ensuring your on-time payments are reported to the three credit bureaus.

Hiring a Credit Repair Professional to Help You

A professional credit repair company like Credit Saint can also help you remove inaccurate negative items like repossessions from your credit report. They have many years of experience helping people, and they make sure the job gets done correctly.

They can also help you potentially remove late payments, charge-offs, collections, foreclosures, and even bankruptcies. If you’ve been struggling with bad credit and are ready to boost your credit scores, call them for a free credit consultation.

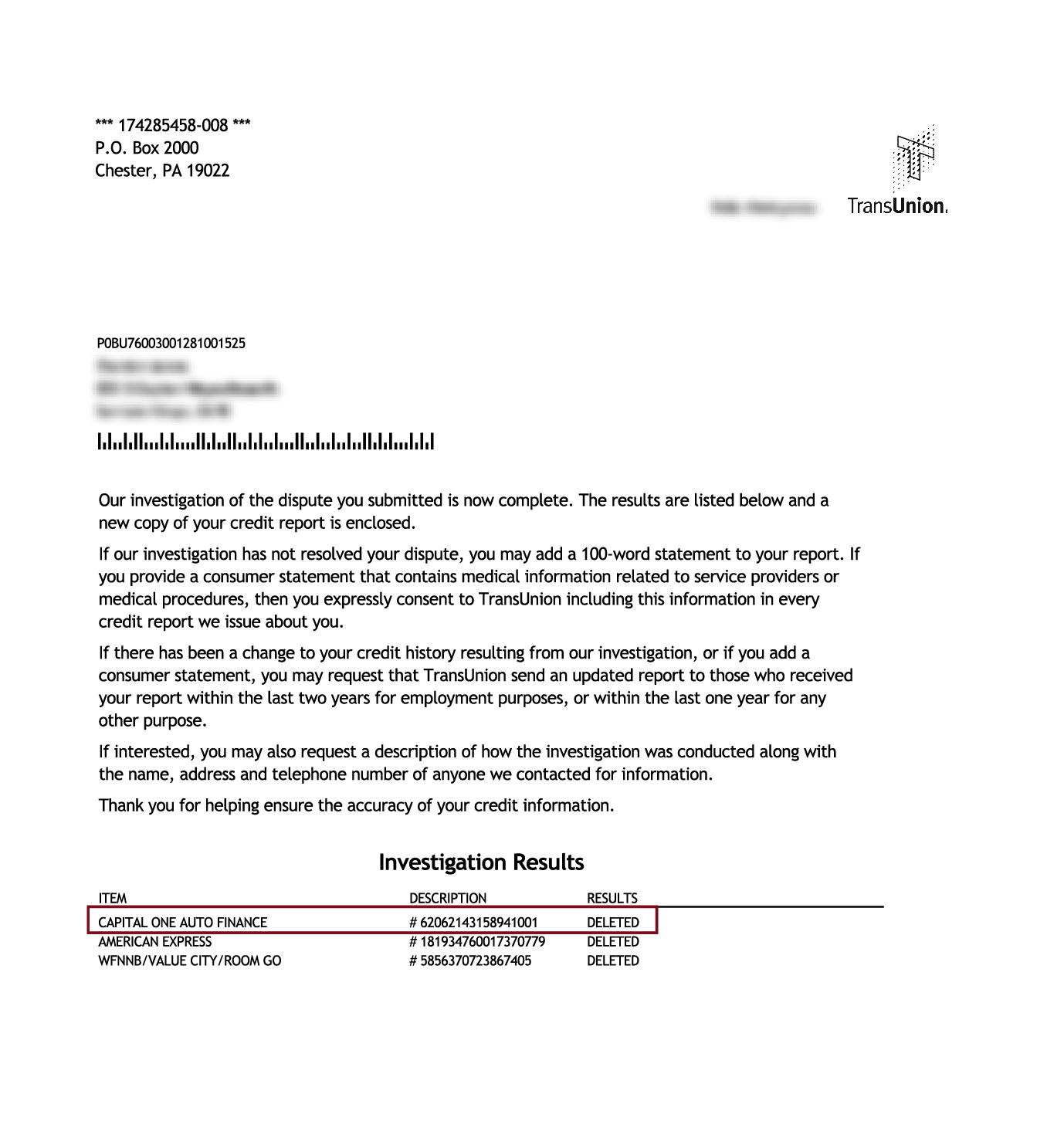

Letter from TransUnion

Ready to Raise Your Credit Score?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.